MSE Trading Report for Week ending 18 February 2022

| MSE Equity Total Return Index: |

| Highlights: |

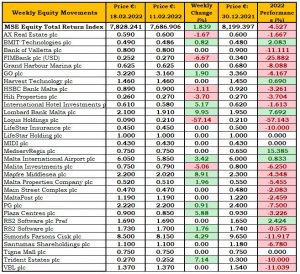

- The MSE Equity Total Return Index (MSE) progressed by 1.8%, as it ended the trading week at 7,828.241 points. A total of 20 equities were active, 12 of which headed north while another six closed in the opposite direction. A total weekly turnover of nearly €0.8m was generated over 150 transactions.

- Malta International Airport plc (MIA) joined the list of gainers after closing flat the previous week. This resulted in a 3.4% increase, to end the week at €6.05. Eleven trades of 5,711 shares were executed.

- This week the company announced January’s traffic results. Last month’s passenger numbers remained 62% below pre-pandemic levels back in 2020, as the effect of restrictions introduced across Europe towards the end of last year rippled into 2022. The average seat load factor for January stood at 55.7%, indicating that just over half the seats available on flights operated to and from MIA were occupied throughout the month. These flights carried a total of 159,357 passengers, with January’s top drivers of traffic being Italy, the United Kingdom, Poland, Germany and France. The company added that the rest of the first quarter of 2022 is expected to be challenging. However, the recent easing of restrictions in important source markets for MIA and the coming into force of the new intra-EU/EEA regime are expected to gradually restore normality in relation to air travel over the coming months.

- Bank of Valletta plc was the most liquid equity of the week, as total turnover stood at €171,462. A total of 214,980 shares changed hands over 40 transactions, leaving the closing price unchanged at €0.80 after trading between a weekly high of €0.82 and a low of €0.785 earlier in the week.

- The share price of its peer, HSBC Bank Malta plc, retracted from the previous week’s closing price of €0.90, as it closed 1.1% lower at €0.89. The equity generated a turnover of €129,966 which was generated over 14 deals.

- The top performer for the week was Lombard Bank Malta plc, as it gained 10%. The banking equity closed the week at €2.10 after trading at a weekly low of €1.90. A total of 9,138 shares changed hands over six transactions worth €17,446.

- International Hotel Investments plc reversed a two-week losing streak by gaining 5.2%, ending the week at €0.61. A total of 39,295 shares exchanged ownership across eight transactions.

- RS2 Software plc Ordinary shares advanced by 1.8% to close at €1.73. Turnover stood at €17,081 as a result of eight trades of 10,032 shares.

- The telecommunications company, GO plc, and its subsidiary BMIT Technologies plc both ended the week in the green. GO plc’s decline of 0.6% on Friday, was not enough to erase Wednesday’s positive performance. The equity finished the week at €3.22, higher by 1.9%. The share price of BMIT increased by just over 0.8%, as seven deals involving 145,120 shares were executed. The equity’s closing price stood at €0.49 and is up by 2.1% since the beginning of the year.

- The food and beverages company, Simonds Farsons Cisk plc ended the week in positive territory, as four trades of 1,630 shares pushed the share price up by 4.3% to the €8.50 level, a price last seen early in January.

- The retail conglomerate, PG plc, was active during all trading sessions, as it traded 12 times over a spread of 70,733 shares. The equity closed at €2.22, higher by 0.9% after recovering from a weekly low of €2.16

- Mapfre Middlesea plc gained 9% to advance to €2.20. A trivial volume of 595 shares were traded over four deals.

- FIMBank plc was active during yesterday’s session to close at $0.252 – an all-time low for the banking equity, and down by 6.7% on the week. Two trades of 3,117 shares were executed.

- A single transaction of 36,000 Hili Properties plc shares dragged the share price lower by 3.7% to €0.26.

- Three trades of 11,500 Plaza Centres plc shares pushed the share price higher by 5.9% to the €0.90 price level.

- Last Monday, VBL plc partially recovered the previous week’s loss of 12.5%. The equity closed the week at €0.27, higher by 7.1%.

- Malta Properties Company plc followed suit with a 2% appreciation to a price of €0.52. The equity traded eight times, as 20,229 shares changed hands.

- Malita Investments plc was one of the few equities to close in the red. Three trades of 30,000 shares resulted in a 5.1% drop in the equity’s price to €0.75.

- Last Thursday, Trident Estates plc advanced by 3.7% which proved to be unsustainable, as the equity closed the week unchanged at €1.37.

- During its first week of trading, AX Real Estate plc was active over a single trade of 2,634 shares. The share price fell by 1.7% to the €0.59 level.

- The company announced that the total issued share capital of the company, amounting to €34m, has been split into 97m Ordinary ‘A’ Shares and 177m Ordinary ‘B’ Shares, both with a nominal value of €0.125. The Ordinary ‘A’ Shares have been admitted to the Official List of the MSE. In addition, the company added that following the full allocation of the €40m bonds, they have been admitted to the Official List of the MSE and trading commenced on February 16.

- The worst performing equity during the week was Loqus Holdings plc, as the share price plummeted to the €0.09 price level, down by 57%. This was a result of two transactions involving 58,725 shares. This is the first time the equity was active in 2022.

- The company announced that the directors are scheduled to meet on February 23, 2022 to consider and if thought fit, approve the half-yearly report of the company for the six months ended December 31, 2021.

- In terms of IPO activity Hili Finance Company plc announced that the bond issue of €50m 4% unsecured bonds 2027 has been over-subscribed and the offer period closed earlier. Announcement of basis of acceptance of the bond will be communicated by latest February 24, 2022.

- In the fixed income market, the MSE Corporate Bonds Total Return Index increased by 0.3% to 1,146.094 points as a result of 54 active issues. The most liquid bond was the 3.5% Simonds Farsons Cisk plc Unsecured € 2027 as it generated a turnover of €0.2m across 11 trades, finishing the week at €104. A total of 239 transactions generated a turnover of €2m.

- The MSE MGS Total Return Index declined by 0.4% to 1,042.605 points. The 2.4% MGS 2041 (I) was the most liquid bond amongst the 19 active issues. The bond generated a total turnover of €0.7m across seven transactions, ending the week at €108.73. A total turnover of €3m was generated across 101 deals.

- In the Prospects MTF market, five issues were active. The 4.75% Orion Finance plc € Unsecured 2027 was the most liquid bond as, €14,000 was generated in turnover across three transactions.

| Upcoming Events | ||||

| 18 February 2022 | MT: M&Z plc – Closure of Share Offer Period | Best Performers: | ||

| 22 February 2022 | MT: HSBC Bank Malta plc – Full-Year Results | LOM | +9.95% | |

| 22 February 2022 | MT: Malta International Airport plc – Full Year Results | MMS | +8.91% | |

| 16 March 2022 | MT: MaltaPost plc – Dividend Payment Date | TRI | +7.14% | |

| 23 March 2022 | MT: Mapfre Middlesea plc – Full Year Results | |||

| 13 April 2022 | MT: HSBC Bank Malta plc – AGM | Worst Performers: | ||

| 20 April 2022 | MT: Lombard Bank Malta – Full Year Results | LQS | -57.14% | |

| 29 April 2022 | MT: Mapfre Middlesea plc – AGM | FIM | -6.67% | |

| 26 May 2022 | MT: Lombard Bank Malta – AGM | MLT | -5.06% | |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]