MSE Trading Report for Week ending 24 November 2023

| Movement in Equity and Bond Indices: |

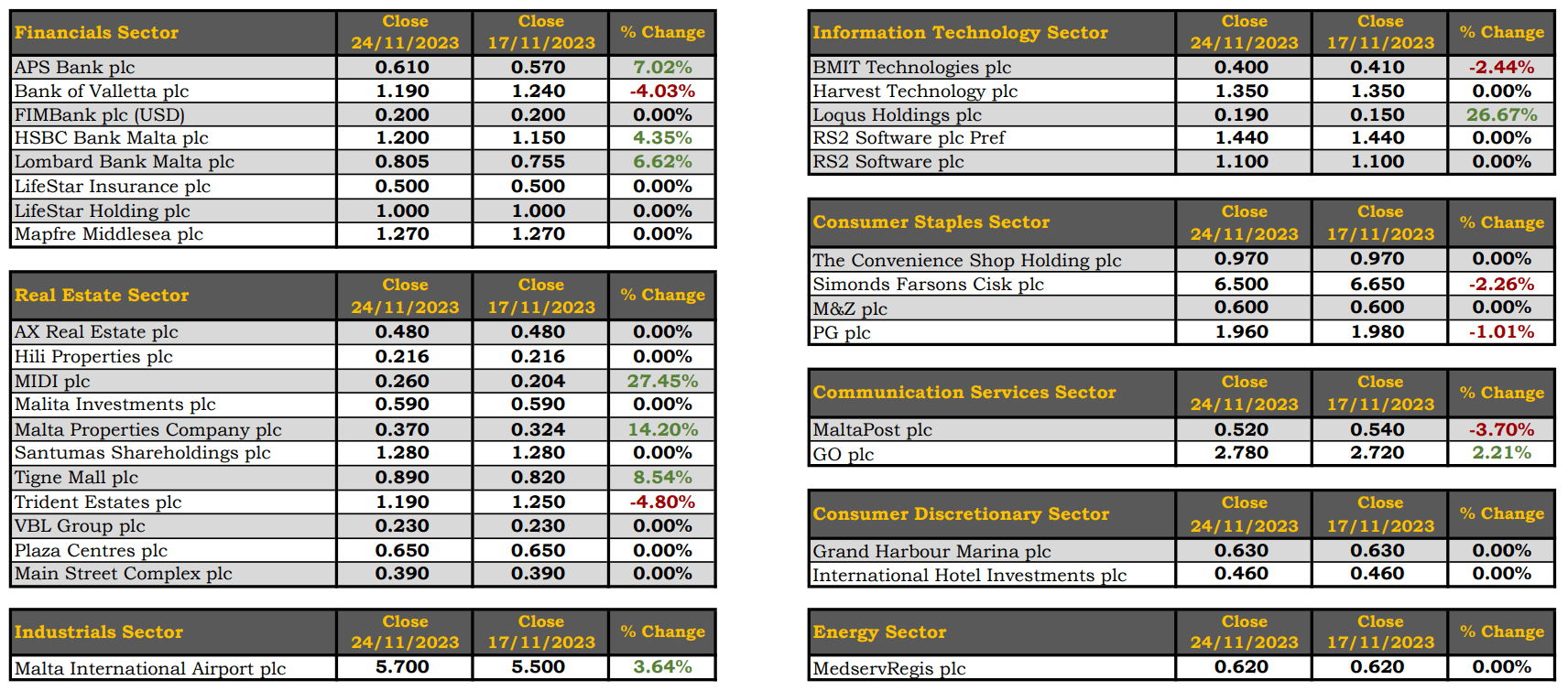

The MSE Equity Total Return Index advanced by nearly 1.4% and closed at 7,740.245 points. During the week, 16 equities were active, as six declined and nine gained. Trading turnover tallied €0.5m, as a result of 89 transactions.

The MSE MGS Total Return Index declined marginally by 0.2%, to end the week at 876.897 points. Out of 12 active issues, four posted gains while another six declined. The best performing government stock was the 0.90% MGS 2031 which experienced an increase of 3%, to end at €81.72. On the downside, the 3.50% MGS 2028 issue suffered the biggest decline, as it dropped by 1.5%, to end the week at €99.75.

The MSE Corporate Bonds Total Return Index closed the week flat at 1,152.185 points. A total of 66 bonds were active, as 28 issues advanced while 21 declined. The 3.5% Simonds Farsons Cisk plc Unsecured € 2027 registered the week’s best performance, gaining 3.6%, to close at par. On the other hand, the 4% Malta Properties Company Plc Sec € 2032 S1/22 T1 suffered the biggest drop, that of 5.5%, to close at €94.

| Market Highlights: |

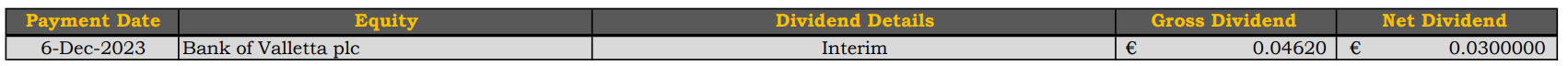

Bank of Valletta plc saw a 4% decrease in its share price. The equity closed the week at €1.19 despite reaching a weekly high of €1.21. A total of 24 trades involving a substantial volume of 121,271 shares were executed, generating €144,272 in turnover.

Simonds Farsons Cisk plc faced a 2.3% decline in its share price, closing at €6.50. The equity witnessed four trades of 1,170 shares worth €7,632.

The share price of Trident Estates plc retracted by 4.8%, ending the week at €1.19. A total of 9,567 shares exchanged hands across two deals.

A decline of 1% in the share price of PG plc, dragged the equity down to €1.96. A total of 11,945 shares worth €23,267 were transacted over four deals.

A single transaction involving 11,300 BMIT Technologies plc shares resulted in a 2.4% decline in its share price. The equity finished the week at €0.40.

MIDI plc registered a double digit increase of 27.5%, closing at a three-month high of €0.26. The equity recorded six trades, involving a weekly volume of 40,000 shares.

APS Bank plc appreciated by 7%, as it closed at a two-month high of €0.61. The banking equity witnessed eight trades worth €37,333.46.

A total of 12 transactions involving 12,650 Malta International Airport plc shares, pushed the share price to the €5.70 level -a gain of 3.6%.

HSBC Bank Malta plc advanced by 4.3%, to close at €1.20. This was the outcome of 126,695 shares spread across 10 transactions. The equity recorded the highest weekly turnover, that of €151,345.

Lombard Bank Malta plc witnessed an increase of 6.6% in its share price, closing at a weekly high of €0.805. The equity transacted twice for a total of €5,264.

| Announcements: |

Last Friday, the board of Phoenicia Finance Company plc announced that it has submitted an application to the MFSA requesting the admissibility to listing of €50 million 5.75% unsecured bonds 2028 – 2033 of a nominal value of €100 per bond issued at par. The bond issue will be guaranteed by Phoenicia Malta Limited and Phoenicia Hotel Company Limited both in terms of annual interest and capital repayment upon maturity.

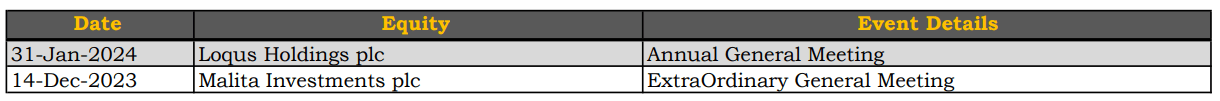

| Upcoming Events: |

| Market Movers by Sector: |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]