MSE Trading Report for Week ending 28 January 2022

| MSE Equity Total Return Index: |

| Highlights: |

RS2, IHI & FIMBank lift the MSE Index

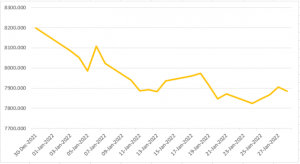

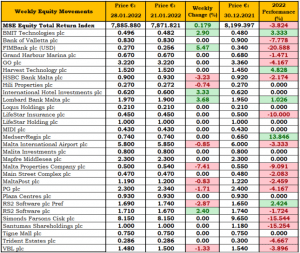

- The MSE Equity Total Return Index (MSE) closed higher by 0.2% at 7,885.880 points after closing in the red the previous three weeks. A total of 16 equities were active, of which five headed higher and eight closed in negative territory. The total weekly turnover increased to €0.7m and was generated over 104 deals.

- In the financial sector, Bank of Valletta plc closed the week unchanged at €0.83 after seeing a weekly high of €0.85 and a low of €0.825. This was the result of 47,214 shares spread over 12 deals for a total turnover of €39,500.

- FIMBank plc recovered some of the lost ground during the past weeks to end the week at $0.27. Five transactions involving 135,031 shares were executed, as the share price gained 5.5% to top the list of best performing equities this week.

- Lombard Bank Malta plc surged by 3.7% to recapture the €1.97 level across 1,216 shares.

- The share price of HSBC Bank Malta plc (HSBC) declined by 3.2% to close the last full week of January at €0.90. A total of 17 trades involving 99,415 shares were executed as the share price of the banking equity traded between a weekly high of €0.92 and a low of €0.85. HSBC generated a turnover of €87,341.

- Malta International Airport plc lost 0.9%, as 2,449 shares changed ownership across three transactions. The equity fell to €5.80 after it started off the week on a negative note and traded unchanged for the rest of the week.

- In the properties sector, 34,500 Hili Properties plc shares were exchanged across two transactions. The share price eased by 0.7% to the €0.27 level.

- International Hotel Investments plc closed higher for the second consecutive week, this week by 3.3% to reach the year’s starting price of €0.62.

- Malta Properties Company plc (MPC) was the most liquid and worst performing equity during this week. The share prices slid by 7.4% as a result of 22 transactions involving 667,232 shares. MPC registered a turnover of €333,965.

- Telecommunications company, GO plc finished the week unchanged at €3.22 after failing to sustain an intra-day high of €3.24 on Monday. Eight trades involving 11,857 shares were executed.

- In the IT sector, BMIT Technologies plc was active twice during the weak to close the week 2.9% higher at the €0.496 level. Turnover totaled to €29,190 as a result of 60,300 shares traded across six deals.

- A sole transaction of only 1,000 shares sent the share price of the RS2 Software plc Preference shares to the €1.69 level, lower by nearly 3%. On the other hand, the company’s Ordinary shares broke off a three weak negative streak. The equity advanced by 2.4% to €1.71. A total of 32,306 shares exchanged hands across 12 transactions.

- The MSE MGS Total Return Index ended the week in the green to close at 1,085.785 points, which translates into a 0.5% increase. A total of 17 issues were active. The 2.3% MGS 2029 (II) was the most liquid bond as a result of four transactions worth €119,400.

- The MSE Corporate Bonds Total Return Index closed marginally lower at 1,144.307 points. Out of the 38 active issues, the newly listed 4.55% St Anthony Co plc Secured € 2032 bond registered the highest turnover of €214,180.

- In the Prospects MTF market, two issues were active, with the most active being the 4.75% Orion Finance plc € Unsecured 2027. This week it has generated a total turnover of € 229,993.

| Upcoming Events | ||||

| 28 January 2022 | MT: Bank of Valletta plc – Dividend payment date | Best Performers: | ||

| 16 February 2022 | MT: MaltaPost plc – AGM | FIM | +5.47% | |

| 16 March 2022 | MT: MaltaPost plc – Dividend payment date | LOM | +3.68% | |

| 20 April 2022 | MT: Lombard Bank Malta plc – Full-year results | IHI | +3.33% | |

| 26 May 2022 | MT: Lombard Bank Malta – AGM | |||

| Worst Performers: | ||||

| MPC | -7.41% | |||

| HSBC | -3.23% | |||

| RS2P | -2.87% | |||

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]