MSE Trading Report for Week ending 17 March 2023

| Movement in Equity and Bond Indices: |

The MSE Equity Total Return Index (MSE) closed in the red, with a 0.6% decline to finish the week at 7,544.883 points. Twenty-one equities were active, ten of which declined and four gained. Turnover halved to €0.6m when compared to the previous week. Malta International Airport plc (MIA) was the main contributor to this week’s decline. Despite this decline, the MSE Index is still up by 1.9% since the beginning of the year.

The MSE Corporate Bonds Total Return Index finished 0.1% lower at 1,126.107 points. A total of 65 issues were active, as 23 advanced while another 23 lost ground. The 4.85% JD Capital plc € Secured Bonds 2032 S1 T1 gained 8.9%, ending the week at €97.99. On the other hand, the 4.5% Shoreline Mall plc Secured € 2032 suffered the biggest drop, as it declined by 10.5% to €85.01.

The MSE MGS Total Return Index recovered marginally by 1.2%, to end the week at 881.714 points. A total of 20 sovereign bonds were active. The 5.25% MGS 2030 (I) was the best performer, as it gained 3%, closing at €113.25. Meanwhile, the 0.9% MGS 2031 (V) suffered the biggest decline, as it dropped by 19.8%, closing at €82.10.

| Market Highlights: |

Malta International Airport plc incurred a loss of 2.6%. Despite starting the week on a positive note and hitting a weekly high of €5.85, the equity closed the week at €5.65. A total of 15,176 shares spread across 16 deals were executed.

The negative performance was also seen in the share price of PG plc. Four transactions worth €61,400 pushed the share price 2.9% lower. The equity ended the week at the €2.

International Hotel Investments plc was active across a sole deal involving just 1,000 shares. The share price retracted to the €0.58 price level, translating to a 1.7% negative movement in price.

Similarly, a sole deal of just 61 Lombard Bank Malta plc shares dragged the share price 7% lower to the €0.93 level.

In the banking sector, Bank of Valletta plc (BOV) traded between a weekly low of €0.895 and a high of €0.92, this week’s closing price. As a result, BOV shares declined by 0.5%. This was the outcome of 80,550 shares spread across 15 deals.

Trident Estates plc was active on a single deal of 5,000 shares on Monday. The equity finished the week at €1.25 – a decline of 3.9% or €0.05.

BMIT Technologies plc was active on Wednesday across three deals involving 128,600 shares. The share price fell by 2.1% to €0.46. BMIT registered a total turnover of €59,782.

On the other hand, GO plc advanced to the €3.18 price level, translating to a positive 2.6% movement in price. This was the outcome of 26,948 shares exchanging ownership across 10 deals.

A single transaction in VBL plc worth €984 pushed the share price 7% higher. The equity ended the week at €0.246.

Likewise, Loqus Holdings plc joined the list of gainers, as 400 shares executed across a single deal, pushed the share price 21% higher to finish at €0.218.

| Announcements: |

Last Wednesday the board of GO announced that for the year ended December 31, 2022 the Group registered total revenues of €214.6, an increase of 10.8% over 2021. This resulted in a Group’s profit after tax of €12.2m for the year ended December 31, 2022 up from €10.4m a year earlier. The AGM will be held on May 11, 2023.

GO also announced that it has concluded a transaction that will result in the subscription of 51% shareholding in Cybersift Holdings Limited.

BMIT Technologies plc announced that the company’s AGM will be held on May 10, 2023.

Malta Properties Company plc (MPC) announced that the company’s AGM will be held on May 17, 2023. The board of MPC approved the company’s financial statement’s for year ended December 31, 2022. Profit after tax increased to €2.3m when compared to €1.3m recorded in the previous year. The directors recommend that at the forthcoming AGM, the shareholders approve the payment of a net dividend of €0.013 per share after taxation.

The board of Malita Investments plc resolved to recommend to the AGM the approval of a final net dividend of €3.8m or €0.0254 per share. The final dividend includes the already paid interim dividend of net €1.7m or €0.0112 per share. The company registered a profit after tax of €8.8m for the year ended December 31, 2022, compared to a €20m loss in 2021.

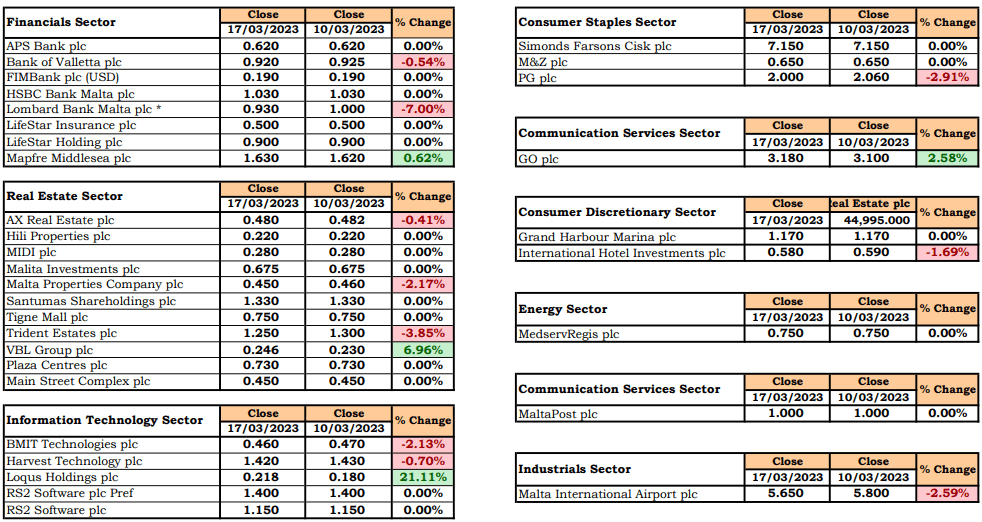

| Market Movers by Sector: |

| Upcoming Events: |

| 22 March 2023 | MT: Mapfre Middlesea plc – Full Year Results |

| 22 March 2023 | MT: FIMBank plc – Full Year Results |

This article, which was compiled by Jesmond Mizzi Financial Advisors Limited, does not intend to give investment advice and the contents therein should not be construed as such. The Company is licensed to conduct investment services by the MFSA and is a Member of the Malta Stock Exchange and a member of the Atlas Group. The directors or related parties, including the company, and their clients are likely to have an interest in securities mentioned in this article. Jesmond Mizzi Financial Advisors Limited is acting as sponsoring brokers for the upcoming BNF Bank plc bond issue. For further information contact Jesmond Mizzi Financial Advisors Limited at 67, Level 3, South Street, Valletta, or on Tel: 21224410, or email [email protected]